Do you need assistance with global payroll services in Poland?

Payslip delivers a scale-up advantage for today’s global business leaders, harmonizing global payroll operations to fuel growth efficiency. By standardizing and automating the complexities of global payroll,

Payslip’s Global Payroll Control Platform empowers outperformers to:

- see a bigger picture

- achieve execution excellence

- scale at any dimension

Foundational for global growth, Payslip enables businesses to instantly expand to new regions and countries while still having complete choice of in-country payroll providers and full control of SLA terms. With Payslip, businesses can continuously scale-up, always ready to capture new opportunities in any part of the world. Get in touch with us today.

Ease of Doing Business in Poland: An Overview

Poland is ranked second in Europe and tenth in the world when it comes to the complexity of doing business, according to the latest edition of a ranking that analyses rules and requirements in 77 countries around the world.

The country has risen 24 places since last year in the Global Business Complexity Index (GBCI). The report’s authors cite confusion over fast-changing legislation as a result of the coronavirus pandemic, the need for official translations, and problems with digitization.

However, Poland ranked fifth globally in terms of the value of greenfield projects – meaning completely new foreign investments – announced last year, according to a new report by the United Nations Conference on Trade and Development (UNCTAD).

Payroll in Poland – 2021 Updates

Poland has introduced a new stimulus plan designed to bolster the economy following the COVID-19 pandemic.

According to KPMG the proposed program includes:

- An increase to income for the “tax-free allowance” for low-wage earners.

- An increase to the threshold that triggers for individual taxpayers, application of the higher income tax bracket of 32% to PLN 120,000 (currently PLN 85,528).

- An increase to the total tax and contribution burden for non-deductible health insurance contributions.

- The “return relief” is to encourage employees and entrepreneurs who have settled abroad, to return to Poland. Individuals coming back to Poland would pay half of their individual income tax due within 2 years of their return.

- A new relief related to automation and extension of the existing research and development and intellectual property relief schemes.

- To extend the tax relief regarding Estonian corporate income taxpayers and tax relief to reduce the costs of entering the stock exchange.

- VAT relief - eliminating VAT on settlements within capital groups and introducing the possibility of selecting VAT settlement method for financial transactions.

See all the COVID-19 measures and temporary limitations in Poland here.

Basic Facts about Payroll in Poland

Poland currency, the PLN, is worth 0.25 USD, and the average monthly salary is 7,560 PLN, or $1,915, according to the exchange rates in October 2021. The country is a member of the European Union and is therefore subject to applicable trade agreements and economic regulations.

The corporate tax is 19% and the sales tax is 23%.

Social Security is financed through a dedicated payroll tax. Employers and employees each pay 6.2% of wages up to the taxable maximum of $142,800 (in 2021), while the self-employed pay 12.4%.

Salaries are paid on monthly basis and employees must receive their salary no later the 10th of the following month. There is no legal requirement for 13th-month payments.

Taxes

A company is resident if either its legal seat or its place of management is located in Poland. Resident companies are taxed on their worldwide income.

Non-resident companies are taxed only on their Polish source income.

The most important cost consideration for employers in Poland is the nature of social security contributions. These contributions can range from 19.48-22.14% of an employee’s gross earnings.

After that, employers may come to payment frequency terms directly with their employees. It is legal in Poland to pay your employees daily, weekly, monthly, or even quarterly. Employers withhold an employee’s income and social security taxes from each paycheck, regardless of frequency.

Rates and Thresholds

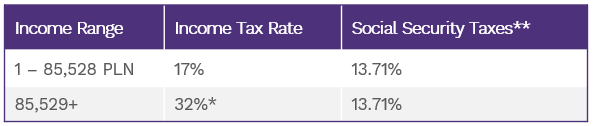

Income taxes in Poland are a bit more straightforward than the United States. There exist only two tax brackets – 18% and 32% – with the watershed income set at 85,528 PLN.

Employees also pay social security taxes (which includes retirement, disability, and healthcare) at a flat rate of 13.71%. For more information, consult the tax chart below.

Returns and Tax Credits

All employers in Poland must complete government forms PIT-4R (due at the end of January) and PIT-11 (due at the end of February). These forms are the United States’ equivalent of a W2 or 1099. And as frustrating as it may sound, employers must get physical, handwritten signatures (the Polish government does not recognize digital signatures) from every employee on both forms before they can be filed.

Employers distribute PIT-11 forms to their employees. Employees are required to pay any non-withheld taxes owed upon filing their taxes by the April 30 deadline. Any employee paid less than 127,000 PLN are allowed certain tax allowances. There also exist tax credits for employees with dependents.

Tax Rate Chart

*The 32% tax rate only applies to annual income above 85,528 PLN. For example, an employee that makes 125,000 PLN a year pays 17% on 85,528 PLN and 32% on the remaining 39,472. Further, an employer deducts these taxes only at the time of year that the employee exceeds 85,528 PLN. Polish employees’ net pay shrinks at the latter part of the year once they’ve reached the 32% tax bracket.

Social security contributions are obligatory and payable by employers. They are financed by both employers and employees. Employers must deduct the appropriate amount from the employees’ salaries and pay the contributions to the social security office by the 15th day of the following month.

Withholding Tax

The general Withholding tax rate on interest and royalties paid to non-residents is 20% (10% regarding services of sea or air transportation). These Withholding tax rates may be reduced by DTTs. There is also a 20% Withholding tax on payments made to non-residents for intangible services (such as consulting services).

Withholding tax is calculated, as a rule, at a rate of 20%. Exceptionally, for some revenues, the withholding tax rate is 10%. In some cases, however, withholding tax may be charged at lower rates (this applies mainly to interest income and royalties).

Compensation and Benefits

There is a decent amount of leeway for employees that agree to work for their employer a large number of hours during a workweek. Polish labor law does set a minimum wage, as well as overtime and minimum paid leave.

Minimum Wage

Currently, Poland requires employers to pay their employees a minimum 2,800 PLN/month if they work full-time. In July 2021 the government announced that from 1 January 2022, they plan to raise the minimum remuneration for work in Poland to 3,000 PLN gross.

Overtime

Employees may negotiate with their employers for either premium overtime pay or days off instead of overtime pay. If an employee works nights, Sundays, or holidays, they are entitled to double pay.

For overtime merely beyond a regular 46-hour workweek, employees receive pay and a half. The maximum overtime hours are 48 hours per working week.

Hours of Work

Working time in Poland should not exceed 8 hours per day and an average of 40 hours per an average five-day working week. Work days begin at 8am and end at 4pm. Naturally, many industries – healthcare, retail, hospitality, etc. – work on different business hours, but the 46-hour workweek remains a general standard.

Under normal circumstances, employees are off Sundays and holidays unless they are being paid overtime.

Holiday & Leave

In Poland, there are 13 national holidays to include Christmas, New Years, Independence Day, and Christian holidays.

Employees working for their employers 10 years or less are entitled to 20 paid vacation days each year. After an employee exceeds 10 years, they are permitted 26 days a year.

For medical leave, employees receive 80-100% of their regular pay depending upon their illness or injury. Maternity leave starts at 20 weeks and can become as long as 45 weeks depending upon birth complications or multiple children to one birth.

Foreign Hires

While there are a number of exceptions, all foreign employees working in Poland must obtain a work permit. Upon acquiring their work permit, they must complete a visa application and submit all necessary documentation for their employer to process. The work permit is only applicable to the job at the time of application; a new application will need to be sought should the employee change job. A work permit is only valid for three years.

For more information about how our Global Payroll Control Platform integrates with local payroll providers in Poland, contact us today