Welcome to the second in our series of short read blogs where we discuss a range of challenges being experienced at global payroll departments at multinational organizations around the world and specifically, how the Payslip platform is designed to solve these challenges. This week's topic is the challenge of managing multiple different local country payroll providers.

The Problem

Adopting a multi-vendor strategy for global payroll is an excellent strategy for companies with high-growth ambitions. First of all, it is usually completely necessary- no single provider has the breadth of country coverage needed for most global employers today, so they need to engage with a number of different local country providers to ensure everyone gets paid. Local country specialists can also provide valuable assistance with local compliance, employment law and cultural nuances.

So, what is the issue? Each provider will have their own system and process. This means a global employer is dealing with different systems, data and processes. There is also time zone, cultural and currency differences to consider. Plus, there will be no integrated data flows between the individual providers and the employers HCM and finance systems. The result of this is a lack of visibility, transparency, control and operational oversight.

How Payslip solve it

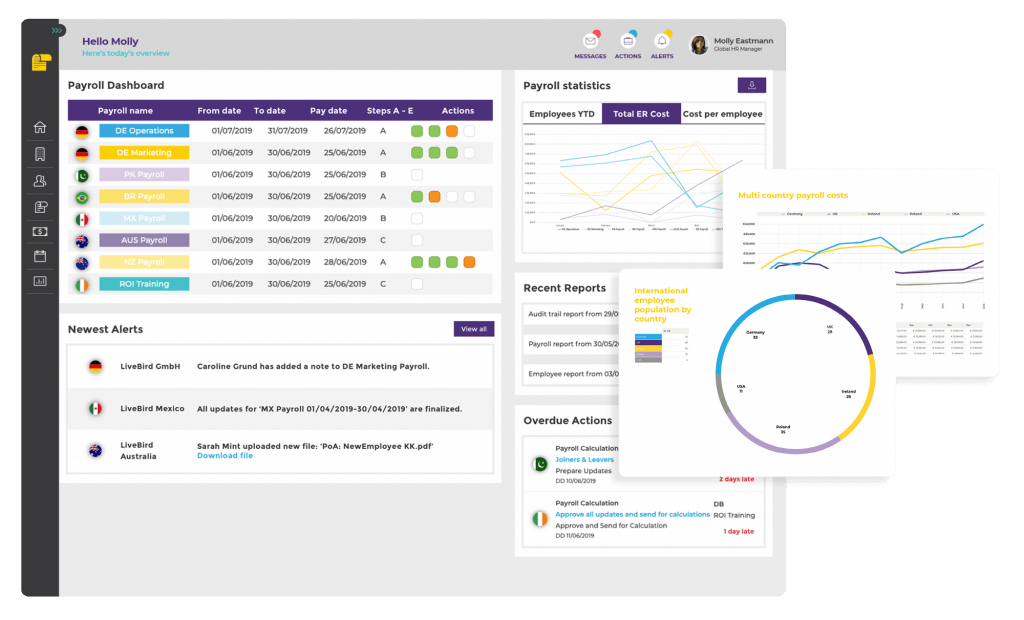

Payslip solve this issue by delivering a technology solution that allows global employers to view, manage and control all of their local country providers on a single platform. The platform enables global employers to bring all of their preferred local providers with them and create a standardized process for the centralized management of global payroll delivery across all of their payroll countries.

Standardizing the data and processes means the employer can see and control what is happening at all times, while Payslip’s reporting suite means they can run reports to compare costs across countries as well as analyze local provider performance. The platform also provides transparent digital audit trails to help prove local country compliance. On boarding new providers or changing providers is quick and easy, so the platform enables global employers to scale with speed into the countries they want to be in. Above all, they benefit from visibility, control and a centralized management of their multi country provider network using next generation technology in a secure, cloud deployed platform.

Stakeholders who benefit

Global employers

Employers get to choose and manage vendors in their own way. They get standardized data and processes along with multicounty consolidated reporting. They get digital audit trails to prove compliance and have the flexibility to onboard new or change providers whenever they need to. They centrally manage their global payroll operations with visibility and control and supply their global payroll professionals with innovative digital tools and smart reporting.

Local vendors

Local payroll providers who are on the Payslip platform have opportunities to connect with global employers who need payroll services in their specific country. They are empowered by digital audit trails which help them prove compliance to their employer. They also enjoy more visibility and control via working with standardized processes inside a single platform where digital communication tools help them collaborate with their professional counterparts and resolve issues.

Leadership teams

Executive teams benefit from a clear and coherent structure being applied to the delivery and management of one of the company's largest expenses, global payroll. They also benefit from comprehensive and in-depth reporting which allows them to compare all of the countries where they are paying employees. They also know that they have in place an agile and responsive technology stack which can facilitate their growth and expansion plans.

If multivendor payroll provider management is a global payroll challenge that you would really like to be solved at your organization, then talk to Payslip today-a member of our team will be happy to talk you through our platform and show you in real-time.